Escrow is an essential part of the real estate transaction and helps make the ‘backend’ process run smoothly. They are your friend through the closing process and will facilitate the final transfer of monies and property.

Escrow is an essential part of the real estate transaction and helps make the ‘backend’ process run smoothly. They are your friend through the closing process and will facilitate the final transfer of monies and property.

Escrow is often referred to a the glue that keeps the transaction together as they work to obtain required signatures on documents, works closely with title officer to clear lines and encumbrances against the property and record information with the county for record. Escrow is an impartial third party as they will receive and follow instructions from both buyers and sellers.

Is escrow needed in a transaction?

It is highly recommended as the process of directing funds and closing correctly is time consuming and confusing for most. Some lenders may even require that escrow is used in the process. Escrow offers a level of protection and convenience that allows for your closing date to be met and appropriate documents recorded. Both the Buyer and Seller relay on the Escrow Agent to carry out their mutually consistent instructions relating to the transaction and to advise them if any of their instructions are not mutually consistent or cannot be carried out. If the instructions from all parties to an escrow are clearly drafted, the Escrow Officer can take many actions on behalf of the Buyer and Seller without further consultation.

How is escrow opened?

Opening escrow is easy and is the first step to take in the closing process. If you are working with a Nor’West real estate broker partner than this step will be taken care of for you and setup to your specific needs. Picking the escrow company to handle your needs is discussed during the negotiations process and specified in the purchase and sale agreement. When you are ready to start the closing process you would deliver the purchase and sale agreement with the earnest money check to the escrow office. This will outline the transaction requirements and provide for the closing date, contingencies, financial details and terms of the transfer. Anyone involved in a transaction can “open escrow ” but traditionally in the Puget Sound it is the seller’s role.

How much does escrow cost?

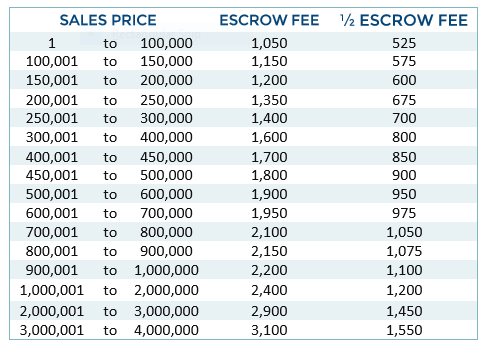

Escrow fees vary slightly between companies and are based on the sales price of the home. Usually the seller and buyer will split this cost unless other arrangements are made.

Average rates in Washington:

Who sets the closing date?

There is a saying in real estate, “everything is negotiable” . Well this may be an overstatement but hold true here. This date is often negotiated depending on the terms of the buyers loan package and the needs of both parties. Although it is very common for the real estate agent to recommend an escrow closer that they have a good relationship with and they trust. (The law prohibits escrow companies from paying referral fees and offer kick backs to real estate agents. This is to protect the parties.)

For more information on specific escrow duties by all parties click here.

(Link this to another page with the ist on the initial post and copied below)

Typical roles in the Escrow process

- Obtains the order for title insurance.

- Obtains approvals from the buyer(s) on pest inspections, the commitment for title insurance, and any other inspections that are called for in the Purchase and Sale Agreement.

- Obtains any required payoffs/release documents to clear title.

- Receives funds from the buyer and/or lender.

- In most cases, prepares vesting document and excise tax affidavit on seller’s behalf.

- Prorates insurance, taxes, rents, etc.

- Prepares a final statement (often referred to as the “HUD Statement” or “Settlement Statement”) for each party, indicating amounts paid in conjunction with the closing of your transaction.

- Oversees the signing of your loan documents.

- Forwards deed to the county for recording.

- Once the proper documents have been recorded, the escrow agent will disburse and distribute funds to the proper parties.

- Delivers a fully executed Purchase and Sale Agreement to the escrow agent.

- Executes the paperwork necessary to close the transaction.

- Deposits evidence of pest inspection and any required repair work, per the Purchase and Sale Agreement.

- Deposits funds required to close (in addition to the purchase price) with the escrow agent.

- Approves any inspection reports, commitment for title insurance, or other items as called for by the Purchase and Sale Agreement.

- Fulfills any other conditions specified in the escrow instructions.

- The Lender (when applicable)

- Deposits proceeds of the loan.

- Directs the escrow agent of the conditions under which the loan funds may be used.

- Process and coordinate the flow of documents & funds.

- Keep all parties informed of progress to the escrow.

- Respond to lender’s requirements.

- Oversee signing of loan/closing documents.

- Obtain approvals of reports and documents from the parties as required.

- Prorate and adjust insurance, taxes, rents, etc.

- Record the deed and loan documents.

- Prepare a final statement outlining funds received and to be disbursed in conjunction with your transaction. Escrow is the process that assembles and processes all the components of a real estate transaction. The transaction is officially closed when the new deed is recorded, thus transferring ownership from the seller to the buyer. The escrow agent is a neutral third party acting on behalf of the buyer and seller under the guidelines set forth by the State of Washington Department of Financial Institutions.